VERIZON COMMUNICATIONS (VZ)·Q4 2025 Earnings Summary

Verizon Surges 6% on $25B Buyback, Best Net Adds Since 2019

January 30, 2026 · by Fintool AI Agent

Verizon delivered a decisive beat on both revenue and EPS while posting its strongest subscriber growth since 2019, sending shares up 6% in after-hours trading. The board authorized a $25B share repurchase program over three years and pulled forward the annual dividend increase. CEO Dan Schulman addressed a January network outage head-on, acknowledging "we let our customers down" before pivoting to results that mark "a critical inflection point" as the turnaround gains traction .

Did Verizon Beat Earnings?

Yes — double beat with accelerating momentum.

*Values retrieved from S&P Global for consensus estimates.

GAAP EPS of $0.55 included $1.7B in severance charges and $583M in asset rationalization costs related to transformation initiatives .

The standout number: 616,000 postpaid phone net additions — the best quarter since 2019 and a 22% improvement from Q4 2024's 504,000 . Total mobility and broadband net adds exceeded 1 million for the first time since 2019 .

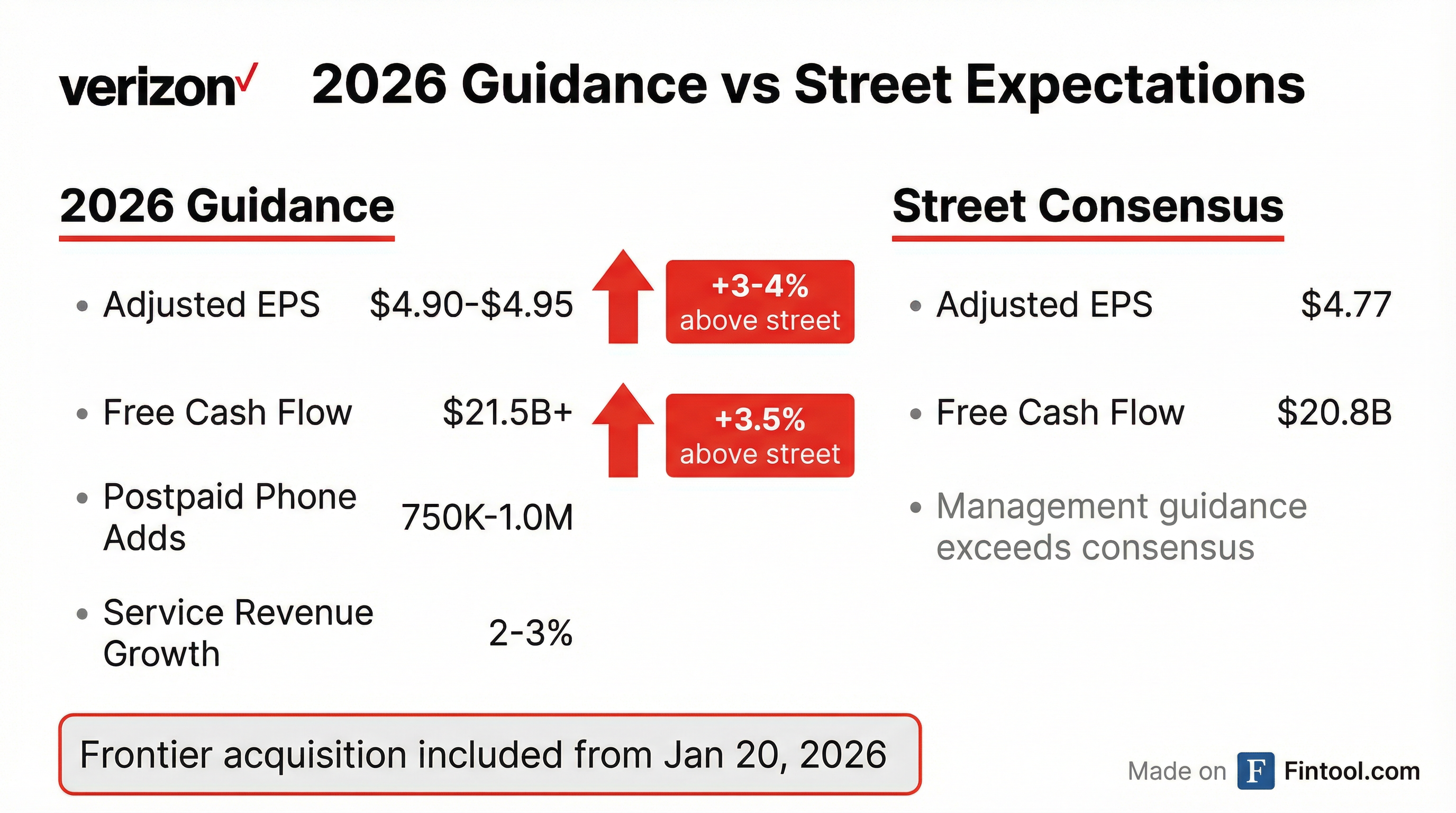

What Did Management Guide?

2026 guidance came in 3-4% above Street expectations across key metrics.

*Values retrieved from S&P Global.

Key guidance commentary from CEO Dan Schulman:

"Our 2026 guidance reflects the beginning of our turnaround, and is a step function change from our past five-year historical average."

All guidance includes Frontier results from January 20, 2026 .

What's the Capital Return Story?

$25B buyback + accelerated dividend = biggest capital return commitment in company history.

CEO Dan Schulman on capital priorities:

"This plan underscores our confidence in the strength of our business, our cash flow generation, and our dedication to driving meaningful shareholder returns. Consistent with our growth profile and cash flow generation, we expect to significantly increase our total return of capital to shareholders over the next three years."

The dividend increase was pulled forward to the first declaration of the year — a signal of confidence .

What's the Cost Transformation Plan?

$5B in OpEx savings targeted for 2026 — creating flexibility to invest and compete.

CFO Tony Skiadas described three waves of efficiency:

- Underperformance removal — eliminating pockets of underperformance, redundant structures, unnecessary management layers

- Complexity reduction — simplifying the customer value proposition and end-to-end experience

- Automation — deploying AI at scale once complexity is removed

"We are building an in-year war chest of $5 billion in OpEx savings... This will allow us to be more agile and reinvest in our business for growth and loyalty, and this is just the beginning of the efficiencies we are uncovering."

What Changed From Last Quarter?

Three major shifts signal a genuine inflection:

1. Subscriber momentum reversed decisively

*Prior quarter values from earlier 8-K filings.

2. Frontier acquisition closed

The $20B Frontier deal closed January 20, 2026, immediately scaling Verizon's fiber footprint to 30+ million homes and businesses . Combined fixed wireless and fiber broadband connections now exceed 16.3 million . Verizon has already paid down $5.7B of Frontier's debt since closing .

3. MVNO agreements modernized

Verizon amended long-term MVNO agreements with Charter and Comcast — "an accretive deal that ensures their customers remain on the best network" . This removes a key competitive overhang.

4. Fiber passings target raised

Management increased the medium-term fiber passings goal to 40-50 million, up from 35-40 million previously, with at least 2 million organic additions in 2026 .

How Did the Stock React?

VZ jumped 6% in after-hours trading — a strong reaction for a defensive telecom.

The magnitude of the after-hours move suggests the market was pricing in a much weaker outlook. Verizon had been a "hunting ground for competitors" — Schulman's words — and skepticism was high heading into the print .

Key Segment Performance

Consumer (75% of Revenue)

Consumer wireless service revenue growth of 1.2% YoY and postpaid ARPA of $147.36 show stable pricing power despite competitive intensity .

Business (20% of Revenue)

Business segment remains under pressure with Enterprise & Public Sector revenue down 6.1% YoY . However, full-year operating income improved 23% to $2.5B as cost discipline offset revenue headwinds .

Full-Year 2025 Summary

Verizon delivered on all 2025 financial guidance targets .

Balance Sheet & Capital Allocation

Gross debt increased $14B to fund the Frontier acquisition preparation, but net leverage actually improved to 2.2x from 2.3x — the second consecutive quarter inside the target range before Frontier closing .

Key balance sheet highlights:

- Pension fully funded — $1.3B in discretionary contributions during 2025

- Frontier debt paydown — $5.7B paid down since January 20 closing

- Leverage impact — Frontier expected to add ~0.25x to leverage ratio once EBITDA contribution factored in

Verizon now has 20 consecutive years of dividend increases, marking its milestone as a dividend aristocrat . The dividend yield remains above 6.5%.

Management Tone Shift

CEO Dan Schulman's rhetoric represents a notable departure from predecessor messaging:

"Verizon will no longer be a hunting ground for our competitors."

"In the past 100 days, there has been a true shift in mindset. We are increasing our speed of decision-making and transforming into a leaner, outcomes-oriented organization."

"This is a new Verizon and we will not settle for anything less than being the best."

The "play to win" mandate marks a strategic pivot from the defensive posture of recent years.

Q&A Highlights

Goldman Sachs (Michael Ng) — On subscriber growth investments:

"If we reduce churn by five basis points, we are already halfway to our target. Every single basis point is 90,000 net adds. 25 basis points times 90,000 is about 2.25 million net adds that we've lost... obviously not all because of price increases, but that would generate $3 billion+ revenues a year for us."

Key insight: Schulman emphasized they don't need aggressive promotions to hit targets — churn reduction is the primary lever. The 750K-1M postpaid phone net add target represents only 10-15% of industry net new-to-market .

Morgan Stanley (Ben Swinburne) — On customer lifetime value:

"LTV is driven by a number of things, but one of the biggest things is churn... We have a large opportunity to address churn. I think it's one of the biggest opportunity sets we have."

Four reasons customers leave, per Schulman: (1) price increases without value, (2) friction in billing/onboarding/service, (3) price perception, (4) competitive intensity .

UBS (John Hodulik) — On revenue composition:

CFO Skiadas detailed 2026 revenue headwinds:

- ~180 bps from lapping prior year price increases

- Ongoing promo amortization pressure

And tailwinds:

- 750K-1M postpaid phone net adds

- Perks adoption and premium plan step-ups

- Continued FWA and fiber volume growth

- Prepaid momentum (6 straight quarters of volume growth)

Citi (Michael Rollins) — On pricing strategy:

"I'm not saying that we don't do price increases, I'm saying we will not do price increases without value... We're not going to capture temporary value, short-term value, at the risk of upsetting our customers and increasing our churn. Again, that defeats the purpose of long-term sustainable growth."

Key Risks to Monitor

-

Integration execution — Frontier is Verizon's largest acquisition ever. Realizing synergies while maintaining service quality will be critical.

-

Competitive intensity — T-Mobile continues to take share. Verizon must sustain subscriber momentum beyond Q4's strong print.

-

Leverage — Gross debt at $158B creates refinancing risk if rates remain elevated.

-

Business segment — Enterprise revenue declines need to stabilize as 5G/edge computing investments mature.

-

Churn creep — Postpaid phone churn rose to 0.95% from 0.88% YoY , suggesting some quality-vs-quantity tradeoff in subscriber adds.

Forward Catalysts

- H1 2026 — New value proposition launch: Management targeting first-half launch of revamped pricing and value proposition; "in deep market research with very sophisticated conjoined analysis"

- Q1 2026: First full quarter with Frontier results; integration progress update

- Fiber build pace: Guidance for 2M+ organic passings in 2026, targeting 40-50M medium-term

- MVNO momentum: Charter/Comcast volumes under amended long-term agreements

- Business stabilization: Public sector volumes expected to improve in H1 as government efficiency disconnects subside

- C-Band completion: Network build to be substantially complete in 2026